At NetWorth Financial Services, we offer a variety of fee-based investment management strategies to help you grow—and protect—your wealth.

We place emphasis on portfolio construction to help both manage volatility and enhance return potential.

At NetWorth Financial Services, we offer a variety of fee-based investment management strategies to help you grow—and protect—your wealth.

We place emphasis on portfolio construction to help both manage volatility and enhance return potential.

We offer a large range of services that can be scaled up or down to meet the needs of multigenerational families, women on their own, and pre-retirees. Schedule a complimentary meeting with us to discuss your personal goals and we will create a custom plan for you.

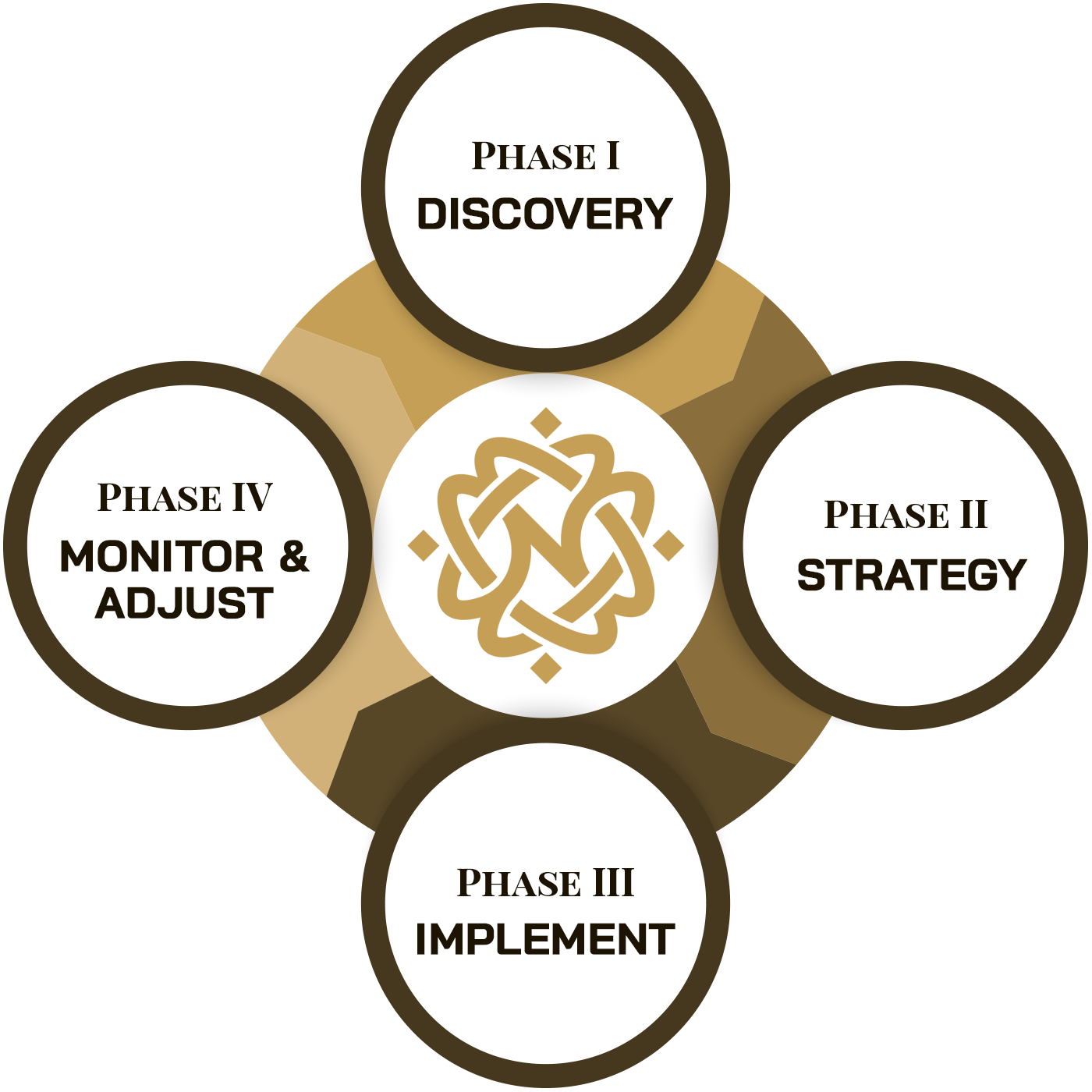

Getting started is easy with Phase I—discovery. We start by uncovering your most heart-felt goals and desires for yourself and your family, followed by Phase II the creation of a customized strategy just for you. From there we meet and refine your strategy, then move forward to implement. Throughout the year we monitor & adjust, meeting annually to formally review. In fact, the process of working together is circular and designed to last throughout your lifetime as your family goes through marriages, births, deaths and other life events that require a change of plan.

11255 Parsons Rd, Suite 200

Johns Creek, Georgia 30097

Phone: (678) 319-0111

Fax: (678) 319-0185

We would love to meet with you to discuss your financial situation and your retirement. We invite you to contact us, give us a call at (678) 319-0111 or fill out this form and we will reach out to you as soon as possible. We look forward to meeting you.